In 2005, Indiana’s economy was struggling. The old Department of Commerce spent around $30,000 in incentives for every job created and still fell behind nearby states.

Governor Mitch Daniels created the Indiana Economic Development Corporation (IEDC) to change that. The new agency was designed to run like a business, with more flexibility and fewer rules about transparency.

At first, it worked. Incentives per job dropped to about $7,000. Indiana attracted Toyota, Honda, and Eli Lilly expansions. Business rankings improved, and the state built a reputation as “open for business.”

But the trade-off was clear from the start. The IEDC had more freedom to cut deals, but less public oversight.

The Dealmaker Culture

The IEDC was built to move fast and land big wins. Legislators and governors supported its secrecy, saying it was necessary to compete with other states.

Over time, the IEDC added affiliates:

-

Elevate Ventures for venture capital

-

Applied Research Institute (ARI) for innovation and federal programs

-

IEDC Foundation for fundraising

-

IIP, LLC for land deals such as the Boone County LEAP District

Each affiliate gave IEDC more ways to move money but with fewer checks and balances. Oversight weakened while the size of the deals grew.

The Arrival of Amazon, Meta, and Google

By the late 2010s, Indiana focused on mega-projects: data centers and distribution hubs.

-

Amazon pledged an $11 billion data center investment with a 50-year sales tax exemption, training grants, and tax credits.

-

Meta announced an $800 million data center in Jeffersonville with a 35-year exemption.

-

Google committed $2 billion for a data center in Fort Wayne.

-

Amazon also expanded massive distribution centers across the state.

On paper, these were huge wins. In practice, the benefits were less clear.

-

Data centers require billions in equipment, power, and water but create relatively few jobs. One deal cost $930,000 in incentives per job created.

-

Distribution hubs created more jobs but often low-wage, high-turnover positions. They also strained roads, sewers, and local services.

The Infrastructure Gap

Indiana often committed to projects before building the infrastructure needed to support them.

Water

Power

-

Data centers are massive electricity users. Indiana’s utilities warn the grid may not keep up.

-

Building new plants and transmission lines will cost billions. Customers are expected to cover much of the cost through higher rates.

Roads and Sewers

-

Warehouses and plants brought heavy truck traffic and new wastewater needs.

-

The state approved more than $60 million in Boone County for roads, water, and land prep to support Eli Lilly and Meta projects.

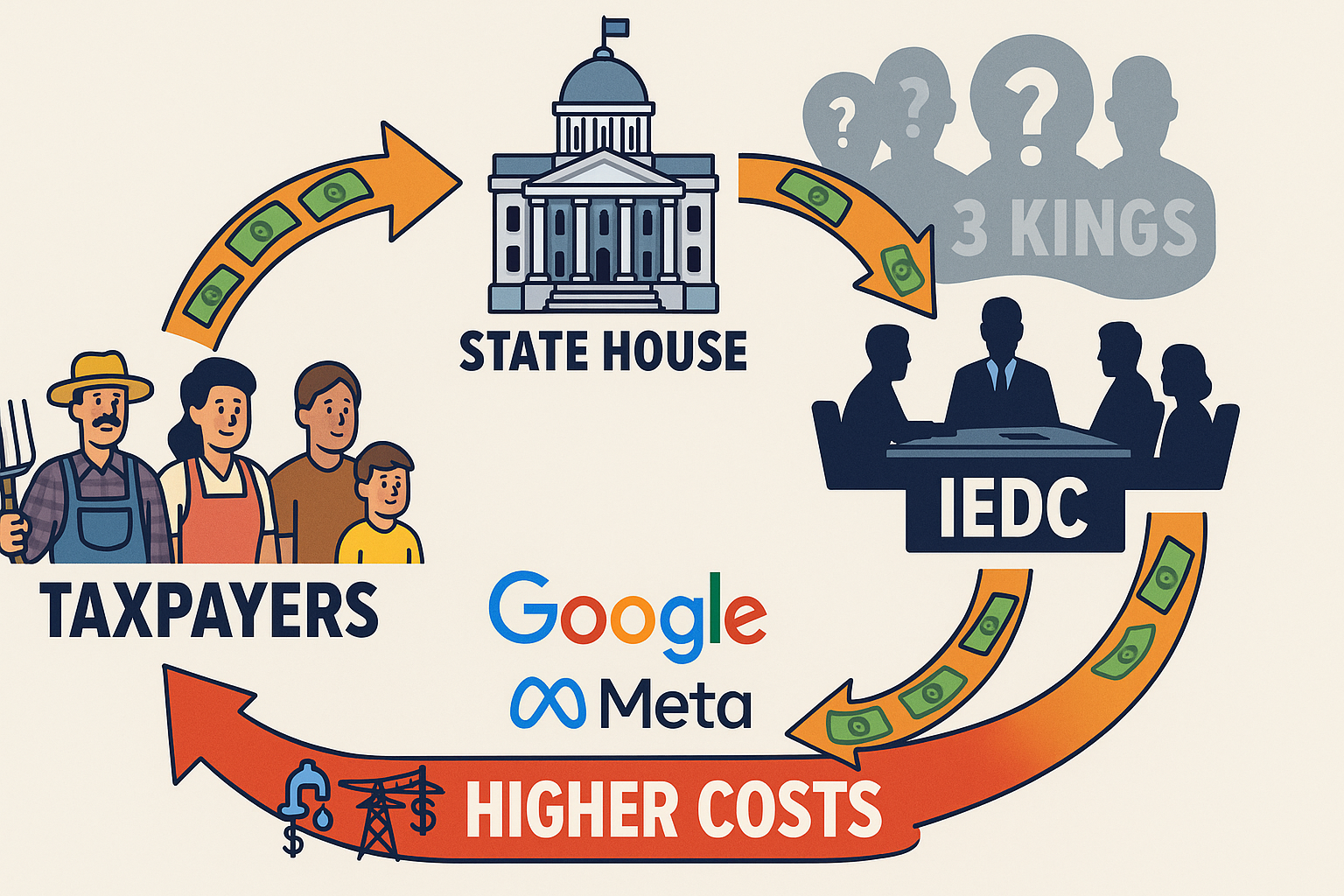

These hidden costs often land on taxpayers and ratepayers rather than the corporations.

The Cracks Appear

By 2024 and 2025, the system began showing strain:

-

Elevate Ventures defaulted on $17 million in loans, leaving a $4.3 million shortfall.

-

Reports surfaced about the “Three Kings” — insiders tied to $180 million in contracts, including a former IEDC executive.

-

Watchdogs warned that data center tax breaks could cost Indiana $2.2 billion in lost revenue.

-

Legislators accused IEDC of selling land at a loss.

-

A forensic audit found no crimes but called for reforms: dissolve the IEDC Foundation, require board approval for deals, and improve transparency.

IEDC as a Symptom

The IEDC itself is not the cause. It is a symptom of how Indiana has chosen to do economic development. For nearly 20 years, state leaders favored big corporate deals over broad-based growth.

The result is a system where:

-

Winners are multinational corporations with decades of tax breaks and subsidized water, power, and roads.

-

Losers are small businesses paying full taxes, residents facing higher bills, and taxpayers who rarely see promised returns.

Why It Matters

-

Your taxes: Incentives and bailouts take money away from schools, roads, and healthcare.

-

Your bills: Water and power rates may rise to pay for pipelines and new plants.

-

Your community: Small businesses rarely get these deals but compete with companies that do.

-

Your trust: Secret negotiations leave citizens in the dark.

The Choice Ahead

Indiana must decide if it will keep chasing mega-projects with hidden costs or shift toward investments that help everyone, like infrastructure, workforce training, and small business support.

This is not about party politics. It is about stewardship. Governors and legislators built this system, defended it, and now must answer for it.

Voters have the power to demand accountability.

✅ Final Takeaway:

Indiana has landed billions in investment and attracted some of the world’s biggest companies. But deals have often come first, while infrastructure and oversight lagged behind. That means taxpayers, ratepayers, and local communities may end up paying the real price for promises made in secret.