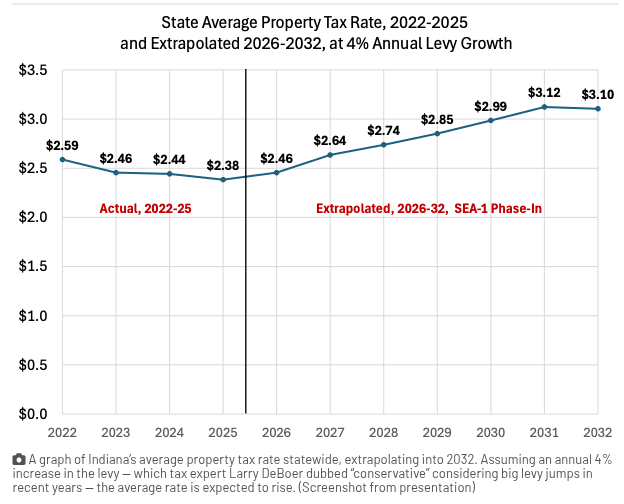

A sweeping property-tax reform passed by the Indiana Legislature is poised to deliver smaller tax bills for owners of pricey homes and large farmland, but the relief isn’t spread evenly. According to analysis by Larry DeBoer of the Indiana Fiscal Policy Institute, many owners of lower-value single-family homes and smaller businesses will feel more pressure under the changes. Indiana Capital Chronicle

The centerpiece is the elimination of the fixed $48,000 homestead standard deduction by 2031, alongside a bump in the supplemental deduction from 37.5 % to 66.7 % over the same period. Indiana Capital Chronicle The analysis shows that these benefits scale with home value, so households in more expensive properties see larger dollar relief, while homeowners in modest homes see comparatively smaller gains or even increases in their tax burden. Homes valued below about $102,740 may end up worse off under the plan. Indiana Capital Chronicle

On the business side, the law raises the exemption for business personal property from $80,000 to $2 million. That’s positive in theory, but DeBoer warns the real-property side of businesses receives no new relief, shifting more of the tax load onto companies with high real property investments. Indiana Capital Chronicle He also cautions that medium-sized firms might exploit structural loopholes to maximize the exemption.

In short: the reform creates winners and losers, farmland and high-value homes win, but small-value homes and certain businesses may bear a heavier tax load as new caps, levies and deductions kick in through 2031.